About 2,000 protesters have staged a noisy rally in central Melbourne against the Federal Government's proposed $7 Medicare co-payment.

Waving placards that read "hands off Medicare" and "stop the cuts", the demonstrators marched from the State Library down Swanston Street to Federation Square, briefly disrupting city traffic.

The rally included many young families and pensioners and heard from doctors, midwives and Opposition health spokeswoman Catherine King.

"Every time the Liberals get into office, they try to destroy Medicare and this is the latest attack from Tony Abbott," Ms King told the crowd.

Changes to Medicare are among the most controversial in the budget and are yet to pass the Senate.

However, a Department of Health phone line is telling callers that the new $7 co-payment will apply from July this year.

Greens Senator Dr Richard Di Natale was also among those to address the crowd.

"Whether you come from Broadmeadows or Brighton, you deserve access to decent health cover," Dr Di Natale said.

Dr Tim Woodruff from the Doctors Reform Society said the Budget was forcing society's most vulnerable to do all the heavy lifting.

Friday, May 30, 2014

Rubbery Joe Hockey's Mince Meat Calculus

Labor had a plan for dealing with the collapse of the international economy, and had considerable success in insulating Australia from its worst effects. As a result, hundreds of thousands of Australians are still working in jobs that would have dissappeared had the government simply sat on its hands or adopted a pro-cyclical "austerity" approach. These hundreds of thousands of workers continued to pay tax, continued to spend their discretionary income, and did not require unemployment benefits. As a result our budget stayed healthy, unlike Greece's, which adopted Hockey's pro-cyclical "austerity" approach.

In September 2013, treasury and the PBO released their projections (PEFO) of the future performance of the economy, based on the fiscal settings then in place . They showed that debt at the time was slightly below $200 billion and would peak at just over $300 billion. According to treasury's analysis, GDP growth would average at around 3.5%, providing healthy revenue streams to the government that would easily fund its commitments and ensure a return to surplus many years before most of our competitors and peers.

Earlier this year, treasury and the PBO issued updated projections (MYEFO) of economic and budget performance, this time based on the pro-cyclical fiscal settings imposed by Mr Hockey on the economy. Although exactly the same "model engine" was used, the figures that popped out were quite different to those in the PEFO, and showed a marked deterioration in the outlook, with peak debt almost doubling to over $600 billion, growth slowing to 2.5% (30% reduction) and the return to surplus delayed by many years.

This is not surprising. If you put beef into a mincer, you get minced beef. If you put pork into a mincer, you get minced pork. The mincer hasn't changed, just what you put into it. When treasury put Labor's counter-cyclical fiscal settings into the mincer, a positive economic outlook was produced. When they put Hockey's pro-cyclical settings into the mincer, a bleak economic outlook was produced.

Hockey can defuse the "timebomb" that he has created with his pro-cyclical settings, simply by reverting to Labor's counter-cyclical settings. But then he would have to admit error and, even more embarrassing, admit that his opponents had it right all along. While this would be a no-brainer for a normal adult, it is an insurmountable hurdle for an intellectually and morally bankrupt Tory narcissist like Hockey. Australia will pay dearly for Hockey's immaturity.

In September 2013, treasury and the PBO released their projections (PEFO) of the future performance of the economy, based on the fiscal settings then in place . They showed that debt at the time was slightly below $200 billion and would peak at just over $300 billion. According to treasury's analysis, GDP growth would average at around 3.5%, providing healthy revenue streams to the government that would easily fund its commitments and ensure a return to surplus many years before most of our competitors and peers.

Earlier this year, treasury and the PBO issued updated projections (MYEFO) of economic and budget performance, this time based on the pro-cyclical fiscal settings imposed by Mr Hockey on the economy. Although exactly the same "model engine" was used, the figures that popped out were quite different to those in the PEFO, and showed a marked deterioration in the outlook, with peak debt almost doubling to over $600 billion, growth slowing to 2.5% (30% reduction) and the return to surplus delayed by many years.

This is not surprising. If you put beef into a mincer, you get minced beef. If you put pork into a mincer, you get minced pork. The mincer hasn't changed, just what you put into it. When treasury put Labor's counter-cyclical fiscal settings into the mincer, a positive economic outlook was produced. When they put Hockey's pro-cyclical settings into the mincer, a bleak economic outlook was produced.

Hockey can defuse the "timebomb" that he has created with his pro-cyclical settings, simply by reverting to Labor's counter-cyclical settings. But then he would have to admit error and, even more embarrassing, admit that his opponents had it right all along. While this would be a no-brainer for a normal adult, it is an insurmountable hurdle for an intellectually and morally bankrupt Tory narcissist like Hockey. Australia will pay dearly for Hockey's immaturity.

Corporate Culture: Tax Loopholes Mock "Heavy Lifting"

UNITED VOICE 29 MAY 2014

Westfield: corporate tax case study

As Australians face a budget of unprecedented harshness and cutbacks, United Voice, one of Australia’s biggest unions, today released research which exposes the low tax rates paid by retail giant Westfield.

As an annual average, Westfield’s effective corporate tax rates in the nine years to 31 December 2013 were:

This falls far short of the 22% estimated average effective tax rate for all ASX200 companies over the past decade. Westfield is Australia’s most profitable real estate corporation and the world’s largest shopping centre owner.

David O’Byrne, Acting National Secretary of United Voice, says “This research reveals that when it comes to heavy lifting on tax, Westfield is missing in action.

“Tax avoidance may not be illegal, but we believe it is immoral and never more than today when low income earners are facing a budget of across-the-board cutbacks. While some corporations are paying their tax, there are others who simply look to exploit any loophole they can.

“Given the huge amount of tax revenue involved, this needs to be an urgent priority of the Abbott Government.

“If Westfield had paid tax at the statutory rate of 30% it could generate additional annual tax revenues of $541 million:

“The Government could do a lot with an extra $541 million every year. For example, it would more than cover the Government’s $1.8 billion in cutbacks to hospitals funding over the forward estimates.

“The Government must get it priorities right. It cannot allow this wholesale corporate tax avoidance to continue.

“Rather than making life even more difficult for low and middle income earners, the Government should ensure corporate Australia fulfils its responsibilities.

“It is time for a major enquiry by the Federal Government to investigate:

“The Prime Minister and Treasurer have talked tough about corporate tax dodgers. Now it’s time to act,” says David O’Byrne.

Westfield: corporate tax case study

As Australians face a budget of unprecedented harshness and cutbacks, United Voice, one of Australia’s biggest unions, today released research which exposes the low tax rates paid by retail giant Westfield.

As an annual average, Westfield’s effective corporate tax rates in the nine years to 31 December 2013 were:

- 8% for the Westfield Group

- 0% for the Westfield Retail Trust

This falls far short of the 22% estimated average effective tax rate for all ASX200 companies over the past decade. Westfield is Australia’s most profitable real estate corporation and the world’s largest shopping centre owner.

David O’Byrne, Acting National Secretary of United Voice, says “This research reveals that when it comes to heavy lifting on tax, Westfield is missing in action.

“Tax avoidance may not be illegal, but we believe it is immoral and never more than today when low income earners are facing a budget of across-the-board cutbacks. While some corporations are paying their tax, there are others who simply look to exploit any loophole they can.

“Given the huge amount of tax revenue involved, this needs to be an urgent priority of the Abbott Government.

“If Westfield had paid tax at the statutory rate of 30% it could generate additional annual tax revenues of $541 million:

- $370 million on average pre-tax profits of $1.7 billion for the Westfield Group

- $171 million on average pre-tax profits of $574 million for the Westfield Retail Trust

“The Government could do a lot with an extra $541 million every year. For example, it would more than cover the Government’s $1.8 billion in cutbacks to hospitals funding over the forward estimates.

“The Government must get it priorities right. It cannot allow this wholesale corporate tax avoidance to continue.

“Rather than making life even more difficult for low and middle income earners, the Government should ensure corporate Australia fulfils its responsibilities.

“It is time for a major enquiry by the Federal Government to investigate:

- reforming Australia’s corporate tax structure

- closing the tax loopholes, such as stapled securities and tax havens

- increasing transparency and disclosure by corporations

“The Prime Minister and Treasurer have talked tough about corporate tax dodgers. Now it’s time to act,” says David O’Byrne.

NZ: International Support Helps Brings Toll to Negotiations

FIRST Union members ratified the new collective agreement with Toll Carriers on 27 May, following the deal being reached in mediation on 26 May.

IndustriALL intervened with BP on 13 May to call for them to force their contractor to the negotiating table with FIRST Union and reach a fair agreement in line with the national standard for the industry.

Hundreds of supporters sent messages through the IndustriALL online solidarity tool to Toll management.

FIRST Union general secretary Robert Reid reported:

Toll remained an aggressive employer right to the end, even beginning the mediation session arguing against a Collective Agreement. However with the strike, pickets of BP petrol stations and international solidarity work continuing, Toll finally agreed to a settlement.

IndustriALL assistant general secretary Kemal Özkan congratulated FIRST Union general secretary Robert Reid:

IndustriALL Global Union is happy and proud to have contributed to the solution of this problem. This is our raison d’etre and we will continue to do so.

FIRST Union organizer Jared Abbott said that workers were happy with the settlement and were looking forward to getting back to work.

In the end the workers were happy to achieve a new collective agreement that included a decent wage increase.

Jared Abbott said the workers were very thankful for all the local and international community support they had received over the past month.

IndustriALL intervened with BP on 13 May to call for them to force their contractor to the negotiating table with FIRST Union and reach a fair agreement in line with the national standard for the industry.

Hundreds of supporters sent messages through the IndustriALL online solidarity tool to Toll management.

FIRST Union general secretary Robert Reid reported:

Toll remained an aggressive employer right to the end, even beginning the mediation session arguing against a Collective Agreement. However with the strike, pickets of BP petrol stations and international solidarity work continuing, Toll finally agreed to a settlement.

IndustriALL assistant general secretary Kemal Özkan congratulated FIRST Union general secretary Robert Reid:

IndustriALL Global Union is happy and proud to have contributed to the solution of this problem. This is our raison d’etre and we will continue to do so.

FIRST Union organizer Jared Abbott said that workers were happy with the settlement and were looking forward to getting back to work.

In the end the workers were happy to achieve a new collective agreement that included a decent wage increase.

Jared Abbott said the workers were very thankful for all the local and international community support they had received over the past month.

Thursday, May 29, 2014

MUA: Wharfies Prepare To Escalate Safety Campaign

Maritime workers are preparing for a "massive escalation" of safety campaigning following the death of a popular Melbourne wharfie last week.

Anthony Attard, a father of three in his mid-40s, was killed aboard the roll-on/roll-off vessel Tasmanian Achiever, docked in the Port of Melbourne, when he was run over by a cargo loader.

The death on 20 May sent shockwaves through the close-knit wharfie community, especially as Mr Attard was a Maritime Union of Australia delegate and representative on the enterprise bargaining committee in his workplace, Toll Group.

MUA officials, including Assistant National Secretary Warren Smith and National Safety Officer Matt Goodwin, spent several days in the workplace last week supporting members in the aftermath of the tragedy.

But as the shock over the death has receded, it has been replaced by anger at a watering down of safety on the wharves since the Abbott Government was elected.

“The way the workers at Toll have rallied together, united, and supported each other, is a credit to each and every one of them,” the union said in a bulletin to members. “The wharfies and seafarers at Toll are a class act, there’s no two ways about it.

“This latest tragedy highlights why we must fight to make sure that safety is mandatory.

“There is a safety crisis in stevedoring. These tragedies are not ‘accidents’. There are causes. That’s why we need regulation.”

In the safety alert sent to members late last week, the MUA said a number of serious safety issues had been identified that had to be fixed before work could again begin at Toll’s Port of Melbourne facilities.

These include lack of a decent traffic management plan, lack of a dedicated spotter and flagman to coordinate the safe movement of people and vehicles on and off the vessel, and lack of commitment to training by Toll.

14 times more likely to be killed at work

But the union says there are wider safety issues in the industry that extend beyond Toll.

Wharf workers are 14 times more likely to die on the job than the average Australian worker.

It says the Abbott Government has blocked a stevedoring code of practice and 12 other lifesaving codes of practice, which have been described as “red tape”.

It has also ordered the Australian Maritime Safety Authority to begin dismantling Marine Order 32, described as “the safety Bible for wharfies for over 30 years”.

The union is advising its members to begin preparing for a “massive escalation” of its waterfront safety campaign, beginning with a two day safety conference next month to chart the way forward.

“The MUA has long campaigned for better safety and now demands that this crisis in waterfront safety be addressed by regulation,” said MUA National Secretary Paddy Crumlin.

“Safety must be mandatory and it must be law.”

Anthony Attard, a father of three in his mid-40s, was killed aboard the roll-on/roll-off vessel Tasmanian Achiever, docked in the Port of Melbourne, when he was run over by a cargo loader.

The death on 20 May sent shockwaves through the close-knit wharfie community, especially as Mr Attard was a Maritime Union of Australia delegate and representative on the enterprise bargaining committee in his workplace, Toll Group.

MUA officials, including Assistant National Secretary Warren Smith and National Safety Officer Matt Goodwin, spent several days in the workplace last week supporting members in the aftermath of the tragedy.

But as the shock over the death has receded, it has been replaced by anger at a watering down of safety on the wharves since the Abbott Government was elected.

“The way the workers at Toll have rallied together, united, and supported each other, is a credit to each and every one of them,” the union said in a bulletin to members. “The wharfies and seafarers at Toll are a class act, there’s no two ways about it.

“This latest tragedy highlights why we must fight to make sure that safety is mandatory.

“There is a safety crisis in stevedoring. These tragedies are not ‘accidents’. There are causes. That’s why we need regulation.”

In the safety alert sent to members late last week, the MUA said a number of serious safety issues had been identified that had to be fixed before work could again begin at Toll’s Port of Melbourne facilities.

These include lack of a decent traffic management plan, lack of a dedicated spotter and flagman to coordinate the safe movement of people and vehicles on and off the vessel, and lack of commitment to training by Toll.

14 times more likely to be killed at work

But the union says there are wider safety issues in the industry that extend beyond Toll.

Wharf workers are 14 times more likely to die on the job than the average Australian worker.

It says the Abbott Government has blocked a stevedoring code of practice and 12 other lifesaving codes of practice, which have been described as “red tape”.

It has also ordered the Australian Maritime Safety Authority to begin dismantling Marine Order 32, described as “the safety Bible for wharfies for over 30 years”.

The union is advising its members to begin preparing for a “massive escalation” of its waterfront safety campaign, beginning with a two day safety conference next month to chart the way forward.

“The MUA has long campaigned for better safety and now demands that this crisis in waterfront safety be addressed by regulation,” said MUA National Secretary Paddy Crumlin.

“Safety must be mandatory and it must be law.”

ACTU: Jobs - Not Failed Policies – Will Turn Around Unemployed

28 May, 2014 | ACTU Media Release

Australians looking for work need a Government who creates jobs, not one happy to push them onto the failed ‘work for the dole’ program.

“If the Government was seriously interested in addressing unemployment and getting people off welfare they wouldn’t be forcing people into a program that has been proven not to work, ACTU Secretary Dave Oliver said.

“Research shows that the work for the dole program doesn’t provide real pathways into employment, it doesn’t up-skill participants and it takes valuable time away from job search activities.

“In fact, the research found that participants in the work for the dole program were more likely to remain on unemployment payments than non-participants in the first 6 months after starting.

“All this program does is leave people trapped on the work for the dole – welfare merry-go-round without any hope of getting off.

"The unemployment rate for 15 to 24 year olds is more than double the national average at 12.5 per cent and is projected to rise – the problem is the lack of jobs.

“Unemployed people need support to get into work and they need jobs to go into, they don’t need punitive measures like the failed work for the program.”

Mr Oliver said the lack of coherence in the Government’s employment “strategy” is demonstrated by Senator Abetz advising job seekers to move to Tasmania to pick fruit, while the Prime Minister last week advised Tasmanian job seekers to leave the state in search of employment as well as a Federal Budget that has gutted skills and training investment.

“The Government wiped over half a billion dollars in support for skills including apprenticeships plus around $360 million in support for innovation in the Federal Budget.

“This leaves workers and communities impacted by recent closures and job loses without sufficient support and it provides no new vision or support for jobs or industry of the future.”

Mr Oliver said the measures announced in the Federal Budget that will see unemployed people without access to any sort of safety net for six months were cruel.

“Under the Abbott Government, if you lose your job and through no fault of your own can’t find a new one then you’re on your own. That’s not the Australian way,” Mr Oliver said.

“Today we’ve seen another 450 jobs go at Qantas with a total of 5000 expected to go, the car industry has collapsed and the Government is getting rid of around 16,500 public sector workers – what are these people and their families going to do?

“All Australians who can work should work and that’s why it’s incumbent on Government to ensure the jobs are there.”

Australians looking for work need a Government who creates jobs, not one happy to push them onto the failed ‘work for the dole’ program.

“If the Government was seriously interested in addressing unemployment and getting people off welfare they wouldn’t be forcing people into a program that has been proven not to work, ACTU Secretary Dave Oliver said.

“Research shows that the work for the dole program doesn’t provide real pathways into employment, it doesn’t up-skill participants and it takes valuable time away from job search activities.

“In fact, the research found that participants in the work for the dole program were more likely to remain on unemployment payments than non-participants in the first 6 months after starting.

“All this program does is leave people trapped on the work for the dole – welfare merry-go-round without any hope of getting off.

"The unemployment rate for 15 to 24 year olds is more than double the national average at 12.5 per cent and is projected to rise – the problem is the lack of jobs.

“Unemployed people need support to get into work and they need jobs to go into, they don’t need punitive measures like the failed work for the program.”

Mr Oliver said the lack of coherence in the Government’s employment “strategy” is demonstrated by Senator Abetz advising job seekers to move to Tasmania to pick fruit, while the Prime Minister last week advised Tasmanian job seekers to leave the state in search of employment as well as a Federal Budget that has gutted skills and training investment.

“The Government wiped over half a billion dollars in support for skills including apprenticeships plus around $360 million in support for innovation in the Federal Budget.

“This leaves workers and communities impacted by recent closures and job loses without sufficient support and it provides no new vision or support for jobs or industry of the future.”

Mr Oliver said the measures announced in the Federal Budget that will see unemployed people without access to any sort of safety net for six months were cruel.

“Under the Abbott Government, if you lose your job and through no fault of your own can’t find a new one then you’re on your own. That’s not the Australian way,” Mr Oliver said.

“Today we’ve seen another 450 jobs go at Qantas with a total of 5000 expected to go, the car industry has collapsed and the Government is getting rid of around 16,500 public sector workers – what are these people and their families going to do?

“All Australians who can work should work and that’s why it’s incumbent on Government to ensure the jobs are there.”

Wednesday, May 28, 2014

Cormann: Australia Post Not For Sale

The embattled and rattled post budget Federal Government has promised not to sell Australia Post, according to Finance Minister Mathias Cormann.

The Government still plans to sell the lucrative Medibank Private, which is estimated to be worth about $4 billion, and has commissioned studies with the intent of selling the Royal Australian Mint and Defence Housing Australia.

In budget estimates today, Senator Conman, the brains behing the Hockey budget disaster, outlined several agencies that would not be privatised.

"We've decided not to proceed with the sale of the ASC we've decided not to proceed with the sale of Australia Post," he said.

The Government still plans to sell the lucrative Medibank Private, which is estimated to be worth about $4 billion, and has commissioned studies with the intent of selling the Royal Australian Mint and Defence Housing Australia.

In budget estimates today, Senator Conman, the brains behing the Hockey budget disaster, outlined several agencies that would not be privatised.

"We've decided not to proceed with the sale of the ASC we've decided not to proceed with the sale of Australia Post," he said.

ICAC: Dismiss NSW SES Commissioner

The New South Wales corruption watchdog has recommended State Emergency Service (SES) Commissioner Murray Kear be dismissed and prosecuted for sacking a deputy who blew the whistle on her colleague.

The ICAC has found Mr Kear dismissed deputy commissioner Tara McCarthy last year as payback for blowing the whistle on his friend, Deputy Commissioner Steven Pearce.

Ms McCarthy had alleged that Mr Pearce entered into dodgy contracts, misused SES funds to buy roof racks and brakes for his car, misused his SES credit card and fabricated diary notes.

The ICAC found that Mr Kear engaged in corrupt conduct by failing to investigate the allegations because of his friendship with Mr Pearce and sacking Ms McCarthy in reprisal.

In a statement ICAC said both Mr Pearce and Mr Kear were known to each other prior to Mr Pearce applying to join the SES.

"Commissioner Kear sat on the original interview panel when Mr Pearce first applied to join the SES, but did not disclose a conflict of interest," the ICAC stated.

The ICAC recommended the Police Minister consider dismissing Mr Kear, who has been on leave since last year.

"The commission is also of the opinion that the Minister for Police and Emergency Services should give consideration to the taking of action against Mr Kear for disciplinary offences of misconduct with a view to his dismissal," the ICAC said.

The ICAC also recommended the Director of Public Prosecutions consider prosecuting Mr Kear for a breach of the whistleblower's act.

The ICAC has found Mr Kear dismissed deputy commissioner Tara McCarthy last year as payback for blowing the whistle on his friend, Deputy Commissioner Steven Pearce.

Ms McCarthy had alleged that Mr Pearce entered into dodgy contracts, misused SES funds to buy roof racks and brakes for his car, misused his SES credit card and fabricated diary notes.

The ICAC found that Mr Kear engaged in corrupt conduct by failing to investigate the allegations because of his friendship with Mr Pearce and sacking Ms McCarthy in reprisal.

In a statement ICAC said both Mr Pearce and Mr Kear were known to each other prior to Mr Pearce applying to join the SES.

"Commissioner Kear sat on the original interview panel when Mr Pearce first applied to join the SES, but did not disclose a conflict of interest," the ICAC stated.

The ICAC recommended the Police Minister consider dismissing Mr Kear, who has been on leave since last year.

"The commission is also of the opinion that the Minister for Police and Emergency Services should give consideration to the taking of action against Mr Kear for disciplinary offences of misconduct with a view to his dismissal," the ICAC said.

The ICAC also recommended the Director of Public Prosecutions consider prosecuting Mr Kear for a breach of the whistleblower's act.

ACOSS: Focus On Jobs Not Penalising People

Wednesday May 28, 2014

The Australian Council of Social Service has called on the Federal Government to focus on improving job opportunities for young people and strengthen training and education available instead of penalising them at the very time they need support and hope.

“It makes no sense that the government has decided to spend new and precious dollars on restarting the failed work-for-the-dole yet cut programmes that clearly work, flying in the face of all evidence,” ACOSS CEO Dr Cassandra Goldie said.

“The problem in high unemployment areas around the country is the lack of jobs, not inertia on behalf of people who are looking for paid work.

‘‘Past experience shows that work-for-the-dole programs are not effective in helping young people get jobs. Under the previous Coalition government’s scheme, only about one in three participants were still employed three months after the program.

“We know that the main reason for high youth unemployment is that young people were worst affected by the global financial crisis. The overall number of jobs for 16 to 19-year-olds was still below 2007 levels five years later. Employers want 'experience' but how can young people gain experience if they can't get entry-level positions?

“The focus should be on opening up job opportunities for our young people, and this should be done in collaboration with business leaders, investors, local communities and social services to give young people hope, and help them get a foot in the door.

A more effective way to address youth and long term unemployment would be to address skills and capability related barriers to work. A first step would be to increase the availability of places in cost-effective wage subsidy programs (such as Wage Connect), and Youth Connections, providing a subsidy roughly equivalent to the Newstart Allowance to a real employer, and mentoring and sustained supports. This gives young people with work experience they desperately want.

“Instead the government has decided to withdraw support from young people for six months of the year and make it harder for them to put themselves in a position to get paid work.

“Young people are already subject to tough requirements to get assistance - people under 22 years who leave school early are already required to complete school or train, or they lose income support. Those over 21 are required to search for 10 jobs a fortnight and prove it to Centrelink or they risk a loss of payments for eight weeks.

“The Budget has also cut funding to important career counselling and vocational programs such as Youth Connections, which has assisted over 74,000 young people since 2010. Ninety-three per cent of participants in this program were still engaged in study or paid work six months after completing the program in 2012 with most no longer receiving Centrelink payments.

“Similarly, 47% of people out of work for over two years assisted by the Wage Connect wage subsidy scheme retained their positions after the program ended, which is more than double the results achieved under the work for the dole scheme.

"The government has announced that it will pay subsidies of up to $10,000 over two years to employers who hire mature workers over the age of 50. With the rate of unemployment among 15- to 24-year-olds more than double the overall rate (12.5%), this initiative should be extended to people locked out, including our young people.

“Young people want to work and participate in society. Now is the time to invest in their futures, not put further barriers in their way,” Dr Goldie said.

The Australian Council of Social Service has called on the Federal Government to focus on improving job opportunities for young people and strengthen training and education available instead of penalising them at the very time they need support and hope.

“It makes no sense that the government has decided to spend new and precious dollars on restarting the failed work-for-the-dole yet cut programmes that clearly work, flying in the face of all evidence,” ACOSS CEO Dr Cassandra Goldie said.

“The problem in high unemployment areas around the country is the lack of jobs, not inertia on behalf of people who are looking for paid work.

‘‘Past experience shows that work-for-the-dole programs are not effective in helping young people get jobs. Under the previous Coalition government’s scheme, only about one in three participants were still employed three months after the program.

“We know that the main reason for high youth unemployment is that young people were worst affected by the global financial crisis. The overall number of jobs for 16 to 19-year-olds was still below 2007 levels five years later. Employers want 'experience' but how can young people gain experience if they can't get entry-level positions?

“The focus should be on opening up job opportunities for our young people, and this should be done in collaboration with business leaders, investors, local communities and social services to give young people hope, and help them get a foot in the door.

A more effective way to address youth and long term unemployment would be to address skills and capability related barriers to work. A first step would be to increase the availability of places in cost-effective wage subsidy programs (such as Wage Connect), and Youth Connections, providing a subsidy roughly equivalent to the Newstart Allowance to a real employer, and mentoring and sustained supports. This gives young people with work experience they desperately want.

“Instead the government has decided to withdraw support from young people for six months of the year and make it harder for them to put themselves in a position to get paid work.

“Young people are already subject to tough requirements to get assistance - people under 22 years who leave school early are already required to complete school or train, or they lose income support. Those over 21 are required to search for 10 jobs a fortnight and prove it to Centrelink or they risk a loss of payments for eight weeks.

“The Budget has also cut funding to important career counselling and vocational programs such as Youth Connections, which has assisted over 74,000 young people since 2010. Ninety-three per cent of participants in this program were still engaged in study or paid work six months after completing the program in 2012 with most no longer receiving Centrelink payments.

“Similarly, 47% of people out of work for over two years assisted by the Wage Connect wage subsidy scheme retained their positions after the program ended, which is more than double the results achieved under the work for the dole scheme.

"The government has announced that it will pay subsidies of up to $10,000 over two years to employers who hire mature workers over the age of 50. With the rate of unemployment among 15- to 24-year-olds more than double the overall rate (12.5%), this initiative should be extended to people locked out, including our young people.

“Young people want to work and participate in society. Now is the time to invest in their futures, not put further barriers in their way,” Dr Goldie said.

Tuesday, May 27, 2014

Kevin Andrews Wages War On Youth

The social services monster, Kevin Andrews, confirmed people could go longer than six months without receiving any income support but did not name a specific timeframe.

The changes have been criticised by the community sector. The Jobs Australia chief executive, David Thompson, said extending the time that people would be without income support for beyond six months was making a bad situation worse.

He said job providers for unemployed people in stream one receive $11 they can spend on them which could be given to assist with public transport fares to and from job interviews.

“But people still will not have enough to pay for a roof over their head, to pay for food, they do not have the resources to participate in employment search,” he said.

“It is kind of Kafkaesque, what do they do? I don’t understand, as a community, what do we say? Tough? Don’t eat? Sleep on the streets?”

Thompson said “suitable training courses” was soon going to mean “any training course” and unemployed people in regional areas where courses are limited or do not start for a couple of months would be hit even harder.

“There’s going to be a proportion of these young people who are going to have no income support and no alternative,” he said.

Jobs Australia has estimated about 110,000 people a year will have to serve the six-month waiting period for Newstart or Youth Allowance when they apply for income support.

“At the moment, those training places aren’t there and it’s not clear who will provide them or how they will be paid for," a spokesman said. "If the individuals are meant to pay for it themselves through government loans, then that’s going to create further problems because for a lot of these people, it will be a long road back from rock bottom and they might not ever earn enough income to repay their student loans.

“It’s easy to see the government could end up wasting more money on useless training than it saves from the welfare cuts in the first place.”

The changes have been criticised by the community sector. The Jobs Australia chief executive, David Thompson, said extending the time that people would be without income support for beyond six months was making a bad situation worse.

He said job providers for unemployed people in stream one receive $11 they can spend on them which could be given to assist with public transport fares to and from job interviews.

“But people still will not have enough to pay for a roof over their head, to pay for food, they do not have the resources to participate in employment search,” he said.

“It is kind of Kafkaesque, what do they do? I don’t understand, as a community, what do we say? Tough? Don’t eat? Sleep on the streets?”

Thompson said “suitable training courses” was soon going to mean “any training course” and unemployed people in regional areas where courses are limited or do not start for a couple of months would be hit even harder.

“There’s going to be a proportion of these young people who are going to have no income support and no alternative,” he said.

Jobs Australia has estimated about 110,000 people a year will have to serve the six-month waiting period for Newstart or Youth Allowance when they apply for income support.

“At the moment, those training places aren’t there and it’s not clear who will provide them or how they will be paid for," a spokesman said. "If the individuals are meant to pay for it themselves through government loans, then that’s going to create further problems because for a lot of these people, it will be a long road back from rock bottom and they might not ever earn enough income to repay their student loans.

“It’s easy to see the government could end up wasting more money on useless training than it saves from the welfare cuts in the first place.”

Abbott: Cost Cutting Tips For The Homeless

The lavish Canberra home Tony Abbott never moved into has cost the government nearly $120,000.

The full cost of the ill-fated lease – including termination fees and legal advice – was confirmed at a budget estimates committee hearing on Tuesday.

Abbott won the election and declined to live in the $3,000 a week rental property. He instead opted to stay at the Australian Federal Police college when in Canberra – a decision portrayed at the time as a cost-saving measure.

The deputy secretary of the department, Elizabeth Kelly, detailed the costs of the unoccupied home at the hearing.

They included $39,107 for rent, $65,000 for a commercial settlement to terminate the lease in November, $1,403 for a property broker to find the home in the first place and later to look for an alternative tenant, and $14,144 in legal advice on the drafting and ending of the lease.

The full cost of the ill-fated lease – including termination fees and legal advice – was confirmed at a budget estimates committee hearing on Tuesday.

Abbott won the election and declined to live in the $3,000 a week rental property. He instead opted to stay at the Australian Federal Police college when in Canberra – a decision portrayed at the time as a cost-saving measure.

The deputy secretary of the department, Elizabeth Kelly, detailed the costs of the unoccupied home at the hearing.

They included $39,107 for rent, $65,000 for a commercial settlement to terminate the lease in November, $1,403 for a property broker to find the home in the first place and later to look for an alternative tenant, and $14,144 in legal advice on the drafting and ending of the lease.

Monday, May 26, 2014

Abbott Budget Stuck in Bygone Era

Ian Varrender

The Treasurer has argued that lower income groups merely are losing benefits the country no longer can afford while the wealthy are being slugged a higher tax. Both he and the Prime Minister claim that makes it fair, that everyone is sharing the burden.

But it is not that simple. Negative gearing alone is anticipated to cost the budget about $4 billion in lost revenue each year, according to the Grattan Institute. And the wealthy have found it devilishly simple to slash income tax by directing their earnings into superannuation and then pulling it straight out.

Research from the National Centre for Social and Economic Modelling, published this week by Fairfax Media, found the poorest 20 per cent of households would contribute $2.9 billion over four years while the richest 20 per cent would lose $1.8 billion.

The closer you look at this budget, the more it disappoints, the clearer the inequity and the injustice of it all becomes. The inequity isn't simply along socio-economic lines. It is also generational. The young bear the brunt of some of the harshest cuts.

The great tragedy is that this budget tinkers. It shaves here, slices there, slugs an unsuspecting bystander in the wings. There is no overarching vision. And that can be sheeted home to the fact that the Government appears to have little understanding of the underlying problem. Either that, or it chooses to ignore it.

The challenges facing Australia cannot be solved by mere bookkeeping. During the past decade our economy has undergone a major structural transformation that has spawned new sources of wealth but laid waste to vast areas of the economy.

We are now primarily a minerals and energy exporter, industries that are capital intensive but employment light and that largely are foreign owned.

The manufacturing industries that once soaked up vast numbers of semi and unskilled workers in the post-war era no longer exist as new technology has diminished the demand for raw labour and a higher currency has shifted many of those industries offshore.

Service industries - where most of the population now is employed - also are looking to shift jobs offshore via new technology.

We risk creating a vast pool of unemployed and underemployed. That may sound enticing to business leaders hoping for the day when they can slash wages. But the long-term social costs could be severe.

Then there are the demographic shifts. Our population is ageing. That will create an incredible burden on the public purse for health and welfare payments in the future.

But we have a superannuation industry controlled by the four major banks that gouges enormous fees - more than $23 billion last year - from the savings pool.

Do we target the private superannuation system and attempt to reform it? No, we leave it and every other powerful vested interest to dictate policy that will ensure short-term benefits for those with the means to wield influence.

Do we tax miners? No, we hit unemployed youth. Do we ensure the generation coming through will be equipped for the challenges of the modern world? No, we cut education funding.

Funding for research and development has been slashed across the board, apart from a whimsical medical research fund that will be funded by the demise of free health care.

The Treasurer has argued that lower income groups merely are losing benefits the country no longer can afford while the wealthy are being slugged a higher tax. Both he and the Prime Minister claim that makes it fair, that everyone is sharing the burden.

But it is not that simple. Negative gearing alone is anticipated to cost the budget about $4 billion in lost revenue each year, according to the Grattan Institute. And the wealthy have found it devilishly simple to slash income tax by directing their earnings into superannuation and then pulling it straight out.

Research from the National Centre for Social and Economic Modelling, published this week by Fairfax Media, found the poorest 20 per cent of households would contribute $2.9 billion over four years while the richest 20 per cent would lose $1.8 billion.

The closer you look at this budget, the more it disappoints, the clearer the inequity and the injustice of it all becomes. The inequity isn't simply along socio-economic lines. It is also generational. The young bear the brunt of some of the harshest cuts.

The great tragedy is that this budget tinkers. It shaves here, slices there, slugs an unsuspecting bystander in the wings. There is no overarching vision. And that can be sheeted home to the fact that the Government appears to have little understanding of the underlying problem. Either that, or it chooses to ignore it.

The challenges facing Australia cannot be solved by mere bookkeeping. During the past decade our economy has undergone a major structural transformation that has spawned new sources of wealth but laid waste to vast areas of the economy.

We are now primarily a minerals and energy exporter, industries that are capital intensive but employment light and that largely are foreign owned.

The manufacturing industries that once soaked up vast numbers of semi and unskilled workers in the post-war era no longer exist as new technology has diminished the demand for raw labour and a higher currency has shifted many of those industries offshore.

Service industries - where most of the population now is employed - also are looking to shift jobs offshore via new technology.

We risk creating a vast pool of unemployed and underemployed. That may sound enticing to business leaders hoping for the day when they can slash wages. But the long-term social costs could be severe.

Then there are the demographic shifts. Our population is ageing. That will create an incredible burden on the public purse for health and welfare payments in the future.

But we have a superannuation industry controlled by the four major banks that gouges enormous fees - more than $23 billion last year - from the savings pool.

Do we target the private superannuation system and attempt to reform it? No, we leave it and every other powerful vested interest to dictate policy that will ensure short-term benefits for those with the means to wield influence.

Do we tax miners? No, we hit unemployed youth. Do we ensure the generation coming through will be equipped for the challenges of the modern world? No, we cut education funding.

Funding for research and development has been slashed across the board, apart from a whimsical medical research fund that will be funded by the demise of free health care.

ACTU: $27 Minimum Wage Increase Needed Now

28 March, 2014 | ACTU Media Release

A $27 wage rise per week for our lowest paid workers is essential if Australia is to avoid creating an underclass of working poor.

ACTU Secretary Dave Oliver said that new research contained within the ACTU submission to the Fair Work Commission's Annual Wage Review shows that if action isn’t taken to increase the minimum wage and turn around the alarming decline in the relative earnings of low paid workers then Australia will have an entrenched working poor as they do in the United States within twenty years.

“A $27 per week increase to the minimum wage will ensure the gap between low paid workers and the rest of the workforce does not widen even further, “Mr Oliver said.

“Australians do not want to live in a country of ‘haves’ and the ‘have-nots’ and the only way for low paid workers to keep up is for the Fair Work Commission to approve this increase.

“That’s why the ACTU is demanding the National Minimum Wage increase to $649.20 a week for Australia's lowest paid including cleaners, retail and hospitality staff, child care workers, farm labourers, and factory workers.

“This would mean a 71 cent per hour increase from $16.37 per hour to $17.08 per hour. We’re asking the Fair Work Commission to increase the lowest award wages by the same amount, $27 per week. For other Award reliant workers above the benchmark tradesperson's rate, Unions seek a 3.7% increase.”

Mr Oliver warned that allowing inequality to worsen will ensure that within 20 years Australia will have a working poor similar to the United States.

“The minimum wage is now just 43.3% of average full time wages - the lowest proportion on record,” Mr Oliver said.

“If action isn't taken, by around 2035 that figure could languish below 30%.

“This will make life in Australia much tougher for low paid workers who will find themselves well and truly left behind. Unions are not going to sit back and let that happen.

"If we want to be the country of the fair go then Australia's minimum wage must be increased.

"It is the responsible thing to do and it is the right thing to do - Australians are emphatic, we do not want a US style underclass of working poor in this country.

"We want a country that gives everyone a fair go and gives everyone dignity and a right to a reasonable and decent quality of living. That's the Australian way.”

Mr Oliver said that only twenty years ago Australia's minimum wage was the highest in the OECD at nearly 60% of average full time wages and ten years on it was hovering around 50%.

“Our research proves there is an urgent and compelling need to turn this decline around,” Mr Oliver said.

“The annual wage review is the only chance for a pay increase for 1.5 million of Australia’s lowest paid workers, and helps set the pay and pay increases of many more.

“Australia is meant to be the country of the fair go but the stats speak for themselves – we’re going down the path of the ‘haves’ and the ‘have-nots’ and the ‘have not’ population is growing.

“Australia is becoming a high cost country to live in and for low paid workers it’s getting harder and harder to get by.

“For those on a low wage, home ownership is a now pipedream. The minimum wage has less than doubled in the past 20 years compared to a 250 per cent increase in housing prices.”

MORE...

A $27 wage rise per week for our lowest paid workers is essential if Australia is to avoid creating an underclass of working poor.

ACTU Secretary Dave Oliver said that new research contained within the ACTU submission to the Fair Work Commission's Annual Wage Review shows that if action isn’t taken to increase the minimum wage and turn around the alarming decline in the relative earnings of low paid workers then Australia will have an entrenched working poor as they do in the United States within twenty years.

“A $27 per week increase to the minimum wage will ensure the gap between low paid workers and the rest of the workforce does not widen even further, “Mr Oliver said.

“Australians do not want to live in a country of ‘haves’ and the ‘have-nots’ and the only way for low paid workers to keep up is for the Fair Work Commission to approve this increase.

“That’s why the ACTU is demanding the National Minimum Wage increase to $649.20 a week for Australia's lowest paid including cleaners, retail and hospitality staff, child care workers, farm labourers, and factory workers.

“This would mean a 71 cent per hour increase from $16.37 per hour to $17.08 per hour. We’re asking the Fair Work Commission to increase the lowest award wages by the same amount, $27 per week. For other Award reliant workers above the benchmark tradesperson's rate, Unions seek a 3.7% increase.”

Mr Oliver warned that allowing inequality to worsen will ensure that within 20 years Australia will have a working poor similar to the United States.

“The minimum wage is now just 43.3% of average full time wages - the lowest proportion on record,” Mr Oliver said.

“If action isn't taken, by around 2035 that figure could languish below 30%.

“This will make life in Australia much tougher for low paid workers who will find themselves well and truly left behind. Unions are not going to sit back and let that happen.

"If we want to be the country of the fair go then Australia's minimum wage must be increased.

"It is the responsible thing to do and it is the right thing to do - Australians are emphatic, we do not want a US style underclass of working poor in this country.

"We want a country that gives everyone a fair go and gives everyone dignity and a right to a reasonable and decent quality of living. That's the Australian way.”

Mr Oliver said that only twenty years ago Australia's minimum wage was the highest in the OECD at nearly 60% of average full time wages and ten years on it was hovering around 50%.

“Our research proves there is an urgent and compelling need to turn this decline around,” Mr Oliver said.

“The annual wage review is the only chance for a pay increase for 1.5 million of Australia’s lowest paid workers, and helps set the pay and pay increases of many more.

“Australia is meant to be the country of the fair go but the stats speak for themselves – we’re going down the path of the ‘haves’ and the ‘have-nots’ and the ‘have not’ population is growing.

“Australia is becoming a high cost country to live in and for low paid workers it’s getting harder and harder to get by.

“For those on a low wage, home ownership is a now pipedream. The minimum wage has less than doubled in the past 20 years compared to a 250 per cent increase in housing prices.”

MORE...

Ged Kearney Address to the ACTU Indigenous Conference

20 May, 2014 | ACTU Speeches & Opinion

Extract:–

This conference comes at a crucial moment in our country’s history.

Last week’s Budget, taking its cue from the National Commission of Audit, was a cruel, heartless document, constructed from a fabric of lies and designed to inflict the maximum pain on the most vulnerable in our society, while protecting the wealthy and privileged.

After concocting a Budget ‘emergency’, Tony Abbott and Joe Hockey used the Budget to advance an ideological agenda devised in the boardrooms of corporate Australia, to make the poor, the aged, the sick and the young feel the pinch so big business can continue on its merry, profit-making way.

This is nothing short of a savage assault on the Australian way of life and famous egalitarianism.

They have taken a wrecking ball to the social wage that unions spent the best part of a century in building.

Clearly the Liberal Government vision is of a harsher, less equal Australia.

Universal healthcare is over with, the introduction of a Medicare co-payment which will put pressure on low income families who for going to the doctor will now become a financial decision.

They are cutting the real value of all pensions – including the age and disability support pensions, and single parents payment – which in today’s terms, will be a cut of about $200 a fortnight by 2030 to those people that can least afford it.

In a disgraceful move young job seekers will need to participate in job search and employment services for six months before they can begin receiving Newstart or youth allowance that will leave these people in poverty.

Young people who are training to learn a trade will lose direct financial support and instead be saddled with debt well into their working lives.

The Government is making it harder for Australians to save for a decent retirement by freezing the increase to the Superannuation Guarantee for four years as well as lifting the retirement age to 70.

Fees for university will go through the roof and students will start paying real interest on their debts and pay them back from a lower income.

Tony Abbott, the self-described “Prime Minister for Indigenous Affairs”, has slashed $534 million from the Indigenous budget through the consolidation of 26 programs down to five.

Tony Abbott, “the Prime Minister for Indigenous Affairs”, has slashed $165 million from the Indigenous health budget.

Tony Abbott, “the Prime Minister for Indigenous Affairs”, has ceased funding for the National Congress of Australia’s First Peoples.

This leaves the only voice for Aboriginal people in the hands of Warren Mundine and the hand-picked Indigenous Advisory Council.

And to rub salt in the wounds, the savings made from these cuts aren’t to be reinvested in more innovative or socially crucial and self-determined programs for Aboriginal and Torres Strait Islander people but will be redirected into the Medical Research Future Fund and to “repair the Budget and fund policy priorities”.

Extract:–

This conference comes at a crucial moment in our country’s history.

Last week’s Budget, taking its cue from the National Commission of Audit, was a cruel, heartless document, constructed from a fabric of lies and designed to inflict the maximum pain on the most vulnerable in our society, while protecting the wealthy and privileged.

After concocting a Budget ‘emergency’, Tony Abbott and Joe Hockey used the Budget to advance an ideological agenda devised in the boardrooms of corporate Australia, to make the poor, the aged, the sick and the young feel the pinch so big business can continue on its merry, profit-making way.

This is nothing short of a savage assault on the Australian way of life and famous egalitarianism.

They have taken a wrecking ball to the social wage that unions spent the best part of a century in building.

Clearly the Liberal Government vision is of a harsher, less equal Australia.

Universal healthcare is over with, the introduction of a Medicare co-payment which will put pressure on low income families who for going to the doctor will now become a financial decision.

They are cutting the real value of all pensions – including the age and disability support pensions, and single parents payment – which in today’s terms, will be a cut of about $200 a fortnight by 2030 to those people that can least afford it.

In a disgraceful move young job seekers will need to participate in job search and employment services for six months before they can begin receiving Newstart or youth allowance that will leave these people in poverty.

Young people who are training to learn a trade will lose direct financial support and instead be saddled with debt well into their working lives.

The Government is making it harder for Australians to save for a decent retirement by freezing the increase to the Superannuation Guarantee for four years as well as lifting the retirement age to 70.

Fees for university will go through the roof and students will start paying real interest on their debts and pay them back from a lower income.

Tony Abbott, the self-described “Prime Minister for Indigenous Affairs”, has slashed $534 million from the Indigenous budget through the consolidation of 26 programs down to five.

Tony Abbott, “the Prime Minister for Indigenous Affairs”, has slashed $165 million from the Indigenous health budget.

Tony Abbott, “the Prime Minister for Indigenous Affairs”, has ceased funding for the National Congress of Australia’s First Peoples.

This leaves the only voice for Aboriginal people in the hands of Warren Mundine and the hand-picked Indigenous Advisory Council.

And to rub salt in the wounds, the savings made from these cuts aren’t to be reinvested in more innovative or socially crucial and self-determined programs for Aboriginal and Torres Strait Islander people but will be redirected into the Medical Research Future Fund and to “repair the Budget and fund policy priorities”.

Friday, May 23, 2014

MUA: Corporate/Government Lies To Public Exposed

The Maritime Union of Australia (MUA) has slammed industry and the Federal Government for misleading the public over the working hours of tugboat deckhands in Port Hedland.

MUA WA Assistant Secretary Will Tracey said tugboat workers worked an average of 2,016 hours per year, the equivalent of almost 54 weeks of a standard 37.5 hour working week.

“Over the course of a year, tugboat workers work six swings of 28 days, at an average of 12 hours a day, and sometimes up to 20 hours a day, depending on the volume of iron ore going through the Port,” Mr Tracey said.

“The total number of hours worked by a tugboat deckhand in a year equates to almost 54 weeks of a standard 37.5 hour working week, such as people might earn if they worked in the Perth offices of BHP Billiton.

“Both industry and the Federal Government are trying to create the impression that these deckhands work only a fraction of the year, in an attempt to portray the MUA as unreasonable and justify a political attack on the union and Australia’s industrial relations laws.

“By misleading the public over the nature of the work performed by these workers, both industry and the Federal Government are showing no respect for the hard work and sacrifice of these workers and their families.”

MUA WA Assistant Secretary Will Tracey said tugboat workers worked an average of 2,016 hours per year, the equivalent of almost 54 weeks of a standard 37.5 hour working week.

“Over the course of a year, tugboat workers work six swings of 28 days, at an average of 12 hours a day, and sometimes up to 20 hours a day, depending on the volume of iron ore going through the Port,” Mr Tracey said.

“The total number of hours worked by a tugboat deckhand in a year equates to almost 54 weeks of a standard 37.5 hour working week, such as people might earn if they worked in the Perth offices of BHP Billiton.

“Both industry and the Federal Government are trying to create the impression that these deckhands work only a fraction of the year, in an attempt to portray the MUA as unreasonable and justify a political attack on the union and Australia’s industrial relations laws.

“By misleading the public over the nature of the work performed by these workers, both industry and the Federal Government are showing no respect for the hard work and sacrifice of these workers and their families.”

Thursday, May 22, 2014

IUF: No To Trade Deals That Threaten Democracy!

Usually we write you with very concrete requests to support workers fighting for their rights in specific conflicts. We know from experience that messages can make a difference, and we appreciate your continued support and solidarity.

This time we're sending a different kind of action alert and asking for a different kind of support.

Governments are currently negotiating, under conditions of strict secrecy, two giant trade and investment treaties which will impact enormously on our lives as workers, citizens and consumers: the EU-US trade deal now known as the Transatlantic Trade and Investment Partnership (TTIP) and the twelve-nation Trans-Pacific Partnership Agreement (TPPA) between Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the United States and Vietnam.

If these treaties come into force, they will weaken elected government and strengthen corporate power at all levels. They must be defeated, and popular pressure can do this, just as it stopped the Multilateral Agreement on Investment and the Free Trade Area of the Americas.

You can download the brochure here. We urge you to read it, distribute it, spread the word in your unions and in your communities, and tell your political representatives "No to trade deals that threaten democrtacy!"

Budget: Smouldering Anger v Smokin' Joe

|

| Smouldering Anger v Smokin' Joe ...................... (cartoon by Matt Golding) |

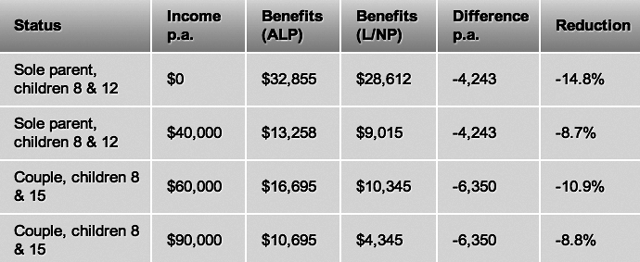

- More than one third of the budget cuts - $6 billion - fall on the middle quintile of households, earning $45,000 to $63,000.

- Families with school-age children are the hardest hit. Across all income groups, they will lose $15.9 billion over four years, more than 90 per cent of the total.

- Low and middle-income sole parents suffer worst of all, losing between 10 and 15 per cent of their annual income - $4000 to $6250 - on family earnings of less than $60,000 by the time the changes to welfare take full effect in 2017-18.

- The burden rises sharply for families with children over the four years of the budget. For example, a sole parent earning $60,000 with children aged eight and 12 will lose $1808 in annual income in 2014-15 and $6278 in 2017-18.

Low- and middle-income earners, especially those with school-age children, are hit hardest as the family tax benefit for single-income families is abolished and indexation is curbed.

SMH Read more:

ACOSS: Socially Harmful Budget

The Australian Council of Social Service has released new analysis revealing that people on low and middle incomes will carry the overwhelming burden of repairing the federal Budget.

“Our analysis brings home the harsh truth that the heavy focus on spending cuts will be socially harmful and cost our nation more in the long run,” said ACOSS CEO Dr Cassandra Goldie.

“The burden of restoring the Budget will not be fairly shared. Over the next four years, people and families living on low incomes will be expected to contribute over half the savings in the Budget (52%), compared with less than one sixth coming from people on high incomes.

“More than $19 billion out of $37 billion (52%) in budget savings in key programs and services over the next four years will come from reductions in spending on programs that mainly assist low and middle income earners. Only $5.7 billion (15%) billion are tax increases or savings in programs mainly benefiting people on high incomes.

“The people that will particularly be affected are those under 30 looking for work, people with disabilities, carers, single parents and struggling low income pensioners and families. The income losses sustained by many people relying income support and family payments are large and crippling.

“Lowering indexation for pensions and freezing family payments for two years will affect families living on low incomes the most and increase poverty and inequality. A single parent on a low income with one child over 6 years stands to lose $50 a week from the changes to Family Tax Benefits alone. We estimate that over a decade, changes to indexation will mean that single people relying on most pensions will be $80 a week worse off.

“New rules will deny income support to young people up to 29 years for six months of every year, unless exempted, resulting in income losses of $207 to $255 a week. Changes to eligibility for the Disability Support Pension are likely to result in more young people currently on this Pension being moved to the much lower Newstart or Youth Allowance, an income loss of at least $166 per week.

“The same people will also be hardest hit by the move to introduce $7 co-payments for doctor’s visits and other services. It will deter patients with severely constrained incomes, particularly those with complex health conditions, from seeking necessary help, leading to more costly hospitalisations down the track.

“In contrast, people with high wealth and incomes will scarcely feel any pain, and much of it will be temporary. There are some efforts to remove or tighten access to a number of poorly targeted entitlements, such as abolishing the Seniors Supplement, capping Family Tax Benefit part B payment at $100,000, and the introduction of a temporary deficit levy. However, measures impacting disproportionately on those with high incomes represent just 15% of the overall savings and revenue measures considered in ACOSS’ analysis.

“Everyone is expected to contribute to repair the Government Budget but more is expected of those with the least ability to pay.

“To be fair and sustainable this budget should have restored public revenue as well as reducing waste on the expenditure side. Three fifths of the decline in the Budget bottom line since the Global Financial Crisis was caused by a loss of revenue, yet the Budget has not begun the process of major structural reform of the tax system. The Budget instead left generous tax concessions that mainly benefit people on higher incomes in the too-hard-basket: superannuation, the treatment of private and company trusts and generous housing tax concessions. It is vital that these are front and centre in the Government’s tax review.

“We urge the government to withdraw the harshest of the spending cuts and start an open dialogue on budget reform to design and build support for the structural change that’s needed on both the revenue and expenditure side. ” Dr Goldie.

“Our analysis brings home the harsh truth that the heavy focus on spending cuts will be socially harmful and cost our nation more in the long run,” said ACOSS CEO Dr Cassandra Goldie.

“The burden of restoring the Budget will not be fairly shared. Over the next four years, people and families living on low incomes will be expected to contribute over half the savings in the Budget (52%), compared with less than one sixth coming from people on high incomes.

“More than $19 billion out of $37 billion (52%) in budget savings in key programs and services over the next four years will come from reductions in spending on programs that mainly assist low and middle income earners. Only $5.7 billion (15%) billion are tax increases or savings in programs mainly benefiting people on high incomes.

“The people that will particularly be affected are those under 30 looking for work, people with disabilities, carers, single parents and struggling low income pensioners and families. The income losses sustained by many people relying income support and family payments are large and crippling.

“Lowering indexation for pensions and freezing family payments for two years will affect families living on low incomes the most and increase poverty and inequality. A single parent on a low income with one child over 6 years stands to lose $50 a week from the changes to Family Tax Benefits alone. We estimate that over a decade, changes to indexation will mean that single people relying on most pensions will be $80 a week worse off.

“New rules will deny income support to young people up to 29 years for six months of every year, unless exempted, resulting in income losses of $207 to $255 a week. Changes to eligibility for the Disability Support Pension are likely to result in more young people currently on this Pension being moved to the much lower Newstart or Youth Allowance, an income loss of at least $166 per week.

“The same people will also be hardest hit by the move to introduce $7 co-payments for doctor’s visits and other services. It will deter patients with severely constrained incomes, particularly those with complex health conditions, from seeking necessary help, leading to more costly hospitalisations down the track.

“In contrast, people with high wealth and incomes will scarcely feel any pain, and much of it will be temporary. There are some efforts to remove or tighten access to a number of poorly targeted entitlements, such as abolishing the Seniors Supplement, capping Family Tax Benefit part B payment at $100,000, and the introduction of a temporary deficit levy. However, measures impacting disproportionately on those with high incomes represent just 15% of the overall savings and revenue measures considered in ACOSS’ analysis.

“Everyone is expected to contribute to repair the Government Budget but more is expected of those with the least ability to pay.

“To be fair and sustainable this budget should have restored public revenue as well as reducing waste on the expenditure side. Three fifths of the decline in the Budget bottom line since the Global Financial Crisis was caused by a loss of revenue, yet the Budget has not begun the process of major structural reform of the tax system. The Budget instead left generous tax concessions that mainly benefit people on higher incomes in the too-hard-basket: superannuation, the treatment of private and company trusts and generous housing tax concessions. It is vital that these are front and centre in the Government’s tax review.

“We urge the government to withdraw the harshest of the spending cuts and start an open dialogue on budget reform to design and build support for the structural change that’s needed on both the revenue and expenditure side. ” Dr Goldie.

Wednesday, May 21, 2014

ABC Cuts: Turnbull Out of Touch

Cuts to the ABC budget will damage the broadcaster’s news and programming output, contrary to claims made by Communications Minister Malcolm Turnbull that cutbacks will be absorbed without hitting programs or its editorial independence.

The ABC will take an initial $120 million budget hit over four years through a combination of a 1% efficiency dividend and the scrapping of the $223 million Australia Network contract. Further cuts are expected to flow from an efficiency study completed in April.

CPSU National President Michael Tull said Mr Turnbull is out of touch with reality to claim that the 1% efficiency dividend announced in the Budget could be easily absorbed.

“Communications Minister Malcolm Turnbull says he expects those efficiencies can be achieved without cutting the ABC’s ‘diverse range of programs and services, or affecting their editorial independence’. It’s clear he didn’t account for the massive cut his colleague Foreign Minister Julie Bishop has inflicted on the ABC by scrapping the Australia Network.

“Sadly reality is catching up with Minister Turnbull, albeit on a 48-hour delay,” said Mr Tull. After meeting with staff and ABC management the CPSU confirms that jobs and programs will be cut. “Australia Network staff and budgets underpin much of the ABC’s foreign coverage so it will have a flow on effect to domestic and international news. The bottom line is that there will have to be cuts to programs and output because it’s not possible for the ABC to do everything - including fulfilling its Charter obligations to be an international broadcaster – but with $120m less,”

“A cut of that size has to affect programs and newsgathering because it is people that make programs. Fewer people means fewer programs,” Mr Tull added. Mr Tull added that the CPSU is concerned that the cut will heap yet more pressure on areas of the ABC that are already stretched thin, such as Arts and Drama.

The ABC will take an initial $120 million budget hit over four years through a combination of a 1% efficiency dividend and the scrapping of the $223 million Australia Network contract. Further cuts are expected to flow from an efficiency study completed in April.

CPSU National President Michael Tull said Mr Turnbull is out of touch with reality to claim that the 1% efficiency dividend announced in the Budget could be easily absorbed.

“Communications Minister Malcolm Turnbull says he expects those efficiencies can be achieved without cutting the ABC’s ‘diverse range of programs and services, or affecting their editorial independence’. It’s clear he didn’t account for the massive cut his colleague Foreign Minister Julie Bishop has inflicted on the ABC by scrapping the Australia Network.

“Sadly reality is catching up with Minister Turnbull, albeit on a 48-hour delay,” said Mr Tull. After meeting with staff and ABC management the CPSU confirms that jobs and programs will be cut. “Australia Network staff and budgets underpin much of the ABC’s foreign coverage so it will have a flow on effect to domestic and international news. The bottom line is that there will have to be cuts to programs and output because it’s not possible for the ABC to do everything - including fulfilling its Charter obligations to be an international broadcaster – but with $120m less,”

“A cut of that size has to affect programs and newsgathering because it is people that make programs. Fewer people means fewer programs,” Mr Tull added. Mr Tull added that the CPSU is concerned that the cut will heap yet more pressure on areas of the ABC that are already stretched thin, such as Arts and Drama.

Hockey's Budget Con-tricks Damage Confidence

The federal budget has damaged consumer confidence, with more people feeling pessimistic about the economy than optimistic, a survey on Wednesday showed.

Westpac’s monthly consumer sentiment index fell by 6.8% in May to 99.7, its lowest point since August 2011.

A reading below 100 points indicates there are more pessimists than optimists on the state of the economy.

The survey was conducted with the Melbourne Institute between May 12 and 17 following the budget announcement.

"The sharp fall in the index is clearly indicating an unfavourable response to the recent federal budget," Westpac chief economist Bill Evans said.

The Westpac survey's result reflects that of the ANZ-Roy Morgan index, which showed consumer confidence had dropped 14% since April when leaks about government spending cuts and the debt levy started to appear.

The ANZ survey, released on Tuesday, was conducted on the weekend after the May 13 budget.

One of the questions in the Westpac survey asked about the impact of the budget on people's finances.

More than 59% of respondents said the budget would make it tougher on family finances in the next 12 months, while just 3.1% said it would improve.

Westpac’s monthly consumer sentiment index fell by 6.8% in May to 99.7, its lowest point since August 2011.

A reading below 100 points indicates there are more pessimists than optimists on the state of the economy.

The survey was conducted with the Melbourne Institute between May 12 and 17 following the budget announcement.

"The sharp fall in the index is clearly indicating an unfavourable response to the recent federal budget," Westpac chief economist Bill Evans said.